Distribution Paid To Cash

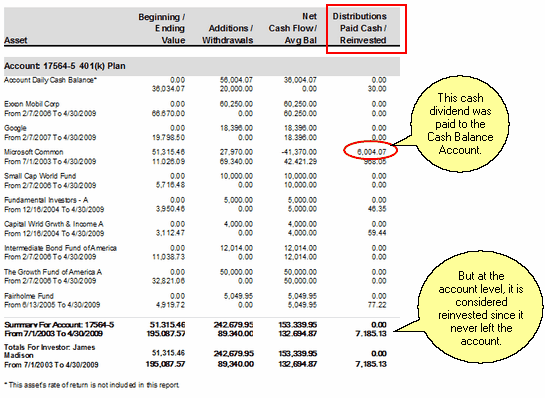

Dividends, Interest, or Capital Gain distribution which are not reinvested back into the same asset are considered cash distributions for that asset.

In the case of a distribution paid into the cash balance account and then reinvested into the SAME asset on the same day, this is considered a reinvested distribution for that asset.

In the case of an Account, if an asset's distribution is paid to the cash balance account and not reinvested into that same asset, then it is considered Paid Out at the asset level, but since it did not leave the account, it is tracked as staying internal to the account and is considered reinvested at the account and investor levels.

In the case of a mutual fund paying a cash distribution directly to the investor, it would be considered Paid Out at the asset and account levels.

Distribution Paid To Cash Example

See Also