Rate of Return - Dollar Weighted

Dollar Weighted Rate of Return is a method of calculating a rate of return that is influenced by cash flows that take place in the account.

Dollar Weighted ROR (Rate of Return) is also known as Money Weighted Rate of Return. It is similar to the Internal Rate of Return (IRR) because it takes into account the timing of the investments.

Dollar Weighted Calculation

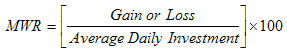

Dollar Weighted or Money Weighted ROR (MWR) is calculated using the following formula:

The MWR is calculated by dividing the gain or loss for the period by a weighted average of the amount invested. Each cash flow is weighted for the number of days it exists in the asset or portfolio during the measuring period. The result is multiplied by 100 to convert it to a percentage.

What Is Dollar Weighted ROR

Think of Dollar ROR as the return of the Investor because it includes the effect of the timing of the buys and sells.

If you're an advisor, it indicates the quality of the timing your advice for the investment, not the actual quality of the investment.

This calculation will be different for the investor who bought and held vs the investor who dollar cost averaged over the same period for the same investment.

Where You Can Find More Information

Dollar Weighted and Time Weighted Return are not easy topics. If you do an Internet search on Time Weighted Return, you can find numerous articles written at many different levels.

See Also

Feibel, Bruce J. Investment Performance Measurement. Hoboken: John Wiley & Sons, Inc., 2003. Print.

Rate of Return Button On View Screen

Rate of Return - Time Weighted