Add/Modify Security Information

On the Sidebar Menu, click on the Investments Bar and then click on the Securities / Indexes Icon. Next, either click the Add Button to add a new security or highlight a security and click the Modify Button.

![]() Add/Modify Securities (9:00)

Add/Modify Securities (9:00)

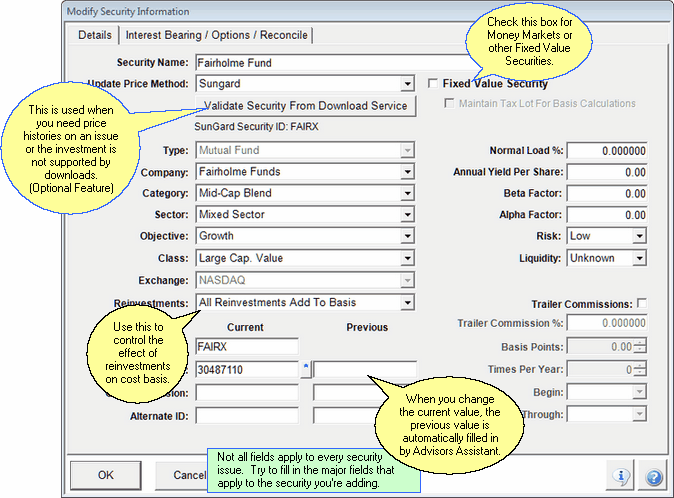

Add/Modify Security Screen Overview

Certain information about an investment, such as the symbol, cusip, and name of the security, only needs to be stored once and then it can be used each time you apply the investment to a client. This is the purpose of the Security Screen.

Security Fields

You don't have to fill in all of the fields. See the hints at the bottom of this help for the most important fields.

Security Name

This is the description of the investment.

Examples

Microsoft Common

AIM Constellation Fund

Fairholme Fund

Fixed Value Security

A fixed value security does not vary in price. It is usually priced at $1 per share. When you check this box, Advisors Assistant will assume the price is $1 per share.

If you have an asset that is hard to value, such as an office building, you may want to assign it as a fixed value and then assign a number of shares equal to the value.

Examples

Money Markets

Certificates of Deposit

Hard to value assets

Maintain Tax Lot For Basis Calculations

Fixed value securities will normally NOT need to have a tax lot history, since the money goes in and out at the same price. Maintaining tax lots can take quite a bit of processor time. In the case of sweep accounts, the sweep account could have several hundred buys and sells throughout the year, causing lots of calculations and storage with no real benefit.

Only check this box if you need a tax lot history.

Update Price Method

Most prices are updated by the clearing house downloads or DST. However, you can elect to have the prices retrieved from Sungard, an optional service offered by Client Marketing Systems, Inc.

If you are downloading information from clearing houses, prices will still be put into the file provided some other method has not placed the prices for that date in the file already. Each method will only overwrite a price if that method inserted the price originally.

Examples

Fixed

Manual

Downloads

Sungard

Validate Security For Download Service Button

When you choose Sungard, this button is automatically pressed for you and the system will allow you to validate the symbol or cusip, or look up the issue by description or key word.

The validation process is necessary because the price service provides additional information to be used to look up the price. It also assures that you receive the correct price.

This is the type of security. If the price method is Sungard, the type is provided and it cannot be changed.

Click on the Type Field to drop down the list. If you have security rights to edit abbreviation lists, you can add abbreviations to the list.

Some Types on the list cannot be edited or removed because the system depends on those items being present for downloads and reports. Others can be edited. When you are in the edit mode, the Editable column indicates which list items can be changed.

Examples

Bond

Mutual Fund

Common Stock

Company

The company issuing the security. This is more important for mutual funds and variable annuities than for stocks.

Examples

American Funds

Microsoft Corporation

United States Department of the Treasury

Category

Some refer to this as the type of investment. All items on this list are editable, so you may redefine the field in any manner.

Category data is not available from downloads, so if you wish to run any reports or asset allocations by category you will need to enter this field for your securities.

Examples

Large Value

Institutional

Global Equity

Sector

The economic sector represented by the security.

Drop down the list by clicking on the field and choose the sector from the list. If you have security rights to edit abbreviation lists, you can add abbreviations to the list.

Sector data is not available from downloads, so if you wish to run any reports or asset allocations by sector you will need to enter this field for your securities.

Examples

Technology

Financial

Mixed

Objective

This is the objective met by the security.

Drop down the list by clicking on the field and choose the objective from the list. If you have security rights to edit abbreviation lists, you can add abbreviations to the list.

Examples

Growth

Income

Capital Preservation

Class

Class and Type are sometimes used interchangeably. We provide this additional descriptive field at the request of our users. Since the lists can be edited, you may use it as you like. See http://www.investorwords.com/866/class.html

Exchange

This field is primarily used by pricing services. It is a low priority field, but is filled in by Sungard during the Validation process. It is the exchange providing the price.

This field lets you control the effect of reinvestments on the cost basis of all investments of this security. It is useful for keeping reinvestments from affecting the basis of annuities.

The choices are:

All Reinvestments Add To Basis

Interest Reinvestments Do Not Add To Basis

No Reinvestments Add To Basis

All Reinvestments Add To Basis

Any shares purchases through dividends or interest reinvested creates a tax lot and will add to the basis. This is recommended even for pension and retirement accounts since unrealized gains are calculated from tax lots.

Interest Reinvestments Do Not Add To Basis

This is a choice so that reinvestments in fixed annuities will not affect the cost basis. Tax lots are not created when interest created by a security is reinvested back into that same security.

No Reinvestments Add To Basis

When any security in an account that creates a dividend or interest distribution and the distribution is reinvested in that security or any other security in the account, or annuity, there is no tax lot created and cost basis is not incremented.

Symbol Code

This is the ticker symbol used to look up the price. Symbol is not a required field, but it is useful and can appear on reports if there is not enough room for the security description.

When Sungard is chosen as the price method, the Symbol field is provided and cannot be changed.

Examples

MSFT

F

IBM

CUSIP

If you don't know the CUSIP, leave the field blank. It is not a required field and is used for downloading certain securities.

This is an identification number used for pricing and clearing. The CUSIP is especially important for DST FAN Mail supported securities.

When a CUSIP is changed, the previous CUSIP is also stored with the security and will be used if the new CUSIP is not found during a download.

Variable Annuities are often referred to by CUSIP but these are not official CUSIPs used industry wide.

DST Vision

If you subscribe to DST Vision, the CUSIP and CUSIP Extension (Fund Code on the DST Website) is important as they are used with the client's account number to log you into Vision and locate the account.

If you cannot log in automatically you will need to set up the preference in User Preferences.

Vision is accessed by Right Clicking on the Account on the View Client With Accounts Screen.

CUSIP Extension

This field is mostly used for variable annuities downloaded through DST FAN Mail. It should not be filled in manually unless directed to do so by our technical support.

Download Note: CUSIP Extensions And Duplicate Securities

DST uses the CUSIP Extension to differentiate various Variable Annuity products and some funds. Advisors Assistant sees a blank extension as a value.

When you are downloading the same security from DST and a clearing firm that uses CUSIPs, such as Pershing, you may see the security listed more than once, with and without the extension. This is normal. Advisors Assistant sees them as two different securities for download purposes.

Alternate ID

This field is used by some clearing houses to uniquely identify a security. It is maintained by the downloads. It should not be filled in manually unless directed to do so by our technical support.

Previous Values

Normally, this field would only be filled in by Advisors Assistant. When you save Security Information, if you have changed the CUSIP, CUSIP Extension, or the Alternate ID that was present when you first entered the screen, the initial value will be copied to the Previous field.

This field is used during downloads when the Current Value (CUSIP, etc.) is not located. The system will look for the security based on the previous value.

The reason for this logic is the fact that a CUSIP may change on a particular date, but you may be processing files prior to that date and also after that date. By keeping the previous generation of values, the downloads can find the correct security.

You can change the Previous field in case you have to remove it (blank it out). If the previous field also contains a legitimate CUSIP or other value, which is very unlikely, but possible, you must have access to the field so you can delete the value.

Normal Load %

Use this field to record the mutual fund's normal load as a percentage. Because individual investors may have lower sales charges, the field is informational only.

Examples

5.5

1.0

Ann Yield Per Share

This is the dollar amount of the security's yield per unit of purchase. It can be used in reports.

Examples

.43

2.33

Information you enter here can be used to run a report which will approximate trailer commissions.

Trailer Commission Checkbox

Checking this box will allow you to fill in the percentage and other trailer commission fields.

Note: Trailer Commissions are not yet implemented in Advisors Assistant.

Trailer Commission %

If a trailer commission is paid on the fund based on the assets under management, this field can be used to predict the amount of commissions that will be due. The amount is expressed as a percentage. Select the percentage for your periodic payment. If you receive 10 basis points per quarter, then it will be appropriate to enter .10.

The percentage you enter is used in the computation on reports.

Examples

.25 (25 basis points)

1.00 (100 basis points)

Basis Points

This field is computed when you fill in the percentage. It is used as information since sometimes trailer commissions are expressed in basis points. When you run a report, the percentage you enter is directly used in the calculation of the trailer commission.

Times Per Year

How many times per year is the commission percentage, that you entered above, paid. For example, if the trailers are 10 basis points 4 times a year, enter 4 in this field and .10 percent for the percentage. (40 basis points total.) This field is not used in the report calculation. If you are paid 4 times a year, the report you run will be run 4 times each year and will show the commission for that period.

This field is not used in any actual calculation. It is informational.

Begin Date

The date that the trailers begin. This will control the other dates if there is more than one payment per year.

Paid Through

If any trailers have already been paid, enter the date they are paid through here. No trailer will be computed prior to this date.

Beta Factor and Alpha Factor

Both of these fields are informational and are not automatically maintained. When they become available in downloads, we will maintain them.

Examples

1.09

.93

Risk And Liquidity

Use the drop list to select the appropriate levels if you plan to use these fields on reports. They are low priority fields.

Examples

Low

Moderate

Semi-Liquid

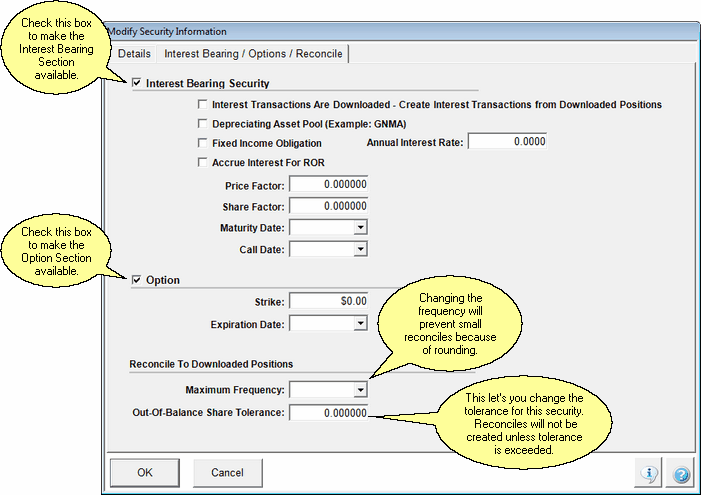

Interest Bearing Securities Tab

If your security is interest bearing, click on the tab Interest Bearing at the top of the Security Screen.

Interest Bearing Security And Annual Interest Rate

Check the Interest Bearing Security Box if the security pays an interest rate and fill in the interest rate. This is used for calculating rate of returns and accrued interest when the rate of return periods are different from the payment periods for bonds.

If this box is checked, you can search on Interest Bearing Securities and get a list of investments which are interest bearing by using the Investment Selection Detail Screen and choosing "Yes" for Interest Bearing.

Interest Transactions Are Downloaded

Some fixed annuities do not send interest transactions in downloads. However, they send a new position which includes interest. This field tells Advisors Assistant that you want to consider any out of balance position to be interest and Advisors Assistant will automatically create an interest transaction instead of a reconcile transaction.

This rule will not apply to an initial reconcile transaction.

This can present problems because if the asset is truly out of balance because of some other reason, you will still get an interest transaction.

Be sure you are familiar with View/Modify Reconciled Positions because this is an alternative to using this checkbox and it gives you more control.

Depreciating Asset Pool

This field is used to indicate that the security is based on a pool of securities, such as mortgages, which will reduce over time. The system maintains a "pool factor" which can change at various dates. Check the box if this security has a depreciating asset pool. The pool factor is maintained with prices. If this box is not checked, you will not be able to enter a pool factor manually.

Fixed Income Obligation

Check the box if the security has a Fixed Income Obligation paying a fixed interest rate paid on a PAR value.

Accrue Interest For ROR

Checking this box tells the system to calculate an accrued interest for interest bearing securities when calculating Rate of Return (ROR). This will have the effect of increasing ROR very slightly. Advisors Assistant will use the interest rate to calculate interest accrued between the last interest payment and the ending date of the ROR Calculation.

Price Factor

This field is normally maintained by the system during downloads, but occasionally must be entered by the users to be able to calculate an accurate market value.

When the downloading clearing house or the pricing authority quotes a price which when multiplied by the number of shares does not produce the actual market value, a price factor is required.

Price x Shares x Price Factor = Market Value

In the case of bonds, the price factor is normally 10.0 because prices are quoted as a percentage of PAR Value.

For more information about the Price Factor, click HERE.

In some cases, downloads do not contain the actual number for shares. For example, 5 corporate bonds may be downloaded as 5,000 units, and the price may be downloaded as 97 (97% of PAR Value.) In this case, Advisors Assistant calculates a factor called the Share Factor which, when multiplied by the number of shares downloaded, will compute the actual number of shares so that the market value can be computed accurately.

This field is normally maintained by the downloading program, but can be entered by the user if needed.

For more information about the Share Factor, click HERE.

Maturity Date

If the security has a maturity date, enter it here.

Call Date

If the security is callable, and you know the Call Date, enter it here.

Option

If the "security" is an option, check this box.

Expiration Date

If the "security" is an Option, enter the expiration date here. Downloaded options will have this date entered by the download based on the Options' symbol.

Strike Price

Enter the strike price of the option. Downloads will enter this price if it is available in the download.

Reconcile To Downloaded Positions

During downloads, positions are sent. If the position and the system differ, a reconcile transaction can be created. This section lets you control how reconcile transactions are created so that very small rounding errors don't create too many positions in the system.

Maximum Frequency

The default for this field is Daily because it is assumed that, if an asset is out of balance, you will want to create a position. This is only available at the Security Level and should only be changed if a particular security is constantly producing small reconcile transactions that you do not want.

Out Of Balance Share Tolerance

This gives you control of when reconciles take place. It can be changed at the system level, the default being .005 shares, or for an individual security.

The reason for both settings is that the .005 shares used by the system may be fine for almost all securities, but on a security such as Berkshire Hathaway, that can represent a significant amount of money. .005 shares represents 10 cents on a $20 share. The smaller the tolerance, the more reconcile transactions you may have.

See Also

Out of Balance Share Tolerance

View/Modify Reconcile Positions

Investment Trailer Commission Reports

|

The security name, type, and, for mutual funds, the company, are the most important fields. Next, the symbol can be important for looking up prices. Category, sector, and objective can enhance reports designed to show charts based on these fields. |