Performance Report Criteria

From the Investment Sidebar Menu, click on the Reports Icon and then click on Performance.

Performance Reports Overview

Advisors Assistant has many different performance reports available to measure your client's investments at the Account, Asset, and Portfolio level. The Performance Report Criteria Screen allows you to zero in on exactly which investor, account, or type of investment you want to appear on your report. You can suppress Account Daily Cash Balance assets when they are zero, liquidated investments, or choose to report on only one account.

By filling in this screen, you have tremendous control over the report.

As with the other report filters, these items provide an AND type of choice. With multiple criteria filled in, only those investment records that match all of the criteria will be selected.

Note: Performance Reports are designed to report on multiple clients. However, choosing criteria that select more than 100 or 200 investors for the same report run may extend the time to run the report. Report times depend on

(1) the speed of the network. If you are using the Internet to connect, it will take longer to send the data to your station.

(2)The amount of memory in your computer. Reports are rendered in memory. If Windows is forced to use "virtual memory" (your hard disk), the report time will be extended.

(3) The speed of your computer. This is just a matter of how fast the processor will render the report.

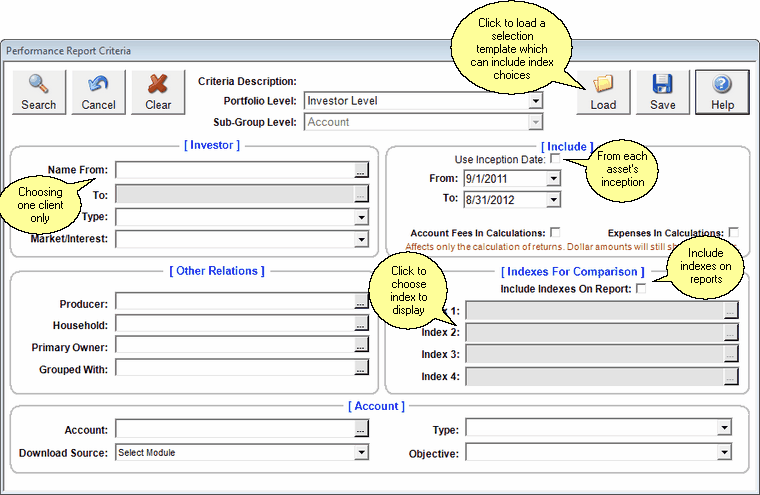

Performance Report Criteria Screen

Load & Save Buttons

You can use these buttons to save sets of criteria that you can use as templates. This is especially useful in saving sets of indexes to place on the reports. If you save a criteria with indexes selected, loading the criteria will show those indexes and then you can just change one or two items in the criteria to customize it.

Save Button

When you have a criteria set up that you may want to use again, click on save and you can give it a descriptive name.

Load Button

Click on this button to see a list of any saved criteria which can be reloaded. Then can just change one or two items such as the client's name, and run the report.

Report Levels

Each report can contain up to 3 levels of consolidation. This drop down list allows you to choose the "top" level of the report.

Normally the level will be (1) Investor, (2) Account, (3) Asset. That means that performance will be reported on each investor, each account for that investor, and each asset within the account.

The second level will always be the Account and the third level will always be the individual asset or investment.

Portfolio Level

The portfolio level is the top level of consolidation.

Investor

This is the default choice. Choose Investor to tell Advisors Assistant to calculate the Investor's Performance and then each account for the Investor, and each asset within the account.

Household

A household can contain several investors. Choosing Household will produce reports which calculate a return for the entire household, each account within the household, and each asset within the account. Each Investor is also identified within each household on the report..

Households are also referred to as Groups when the Head of Household is an organization.

Households are preferred to Grouped With as the top level of the report.

Grouped With

Grouped With is based on the Group With Field contained under the Relations Tab on the Modify Account Information Screen.

The fundamental difference between Grouped With and Households is that Grouped With is selected on the Account Level so you can select just one account without including all of the accounts for that client. This is useful when you want to group certain retirement accounts with the plan sponsor without including all of the investor's accounts.

If you chose to filter based on a Grouped With Name in the Other Relations Section, you should choose Grouped With as the top level.

Sub-Group Level

The Sub-Group Level will always be the Account Level. The field is shown as a reminder and an expansion point for later versions.

Investor Section

This section refers to name-oriented selection criteria. Click on the field to make your choice.

Name

Click on the Name Field to choose one client to report on.

Type

This refers to the Type of Name Field. Click on the field to drop down a list of types. Typically you may choose one of the client types.

Market/Interest

This field refers to the client's Market as set up on the View Client With Markets Screen. You may have set up a Market abbreviation for a group of clients for which you print quarterly reports. You can then select that group of clients by entering that Market in this field.

Include Section

This section refers to asset items that are dynamic and items you may want to change for a given criteria.

Use Inception Date

Checking this box will set the date range as the inception date for each asset. If you set the initial values date for a transaction, then that date will be used.

From / To Date

Use this date range to calculate performance over the range. If an investment's inception date is after the From Date and before the To Date, the beginning value of the investment will be 0 and it will be weighted into all of the calculations only for the time it was present in the range.

Liquidated Investments

Investments which have a liquidated date filled in on or before the beginning of the performance measuring period (From Date) will not be included in the report. If the asset is liquidated during the performance measuring period, it will be included in the report if it meets the other filter criteria.

Account Daily Cash Balance

The account daily cash balance will usually have a balance of zero. However, from time to time, it could have an overnight balance. The account daily cash balance is always included in the report, but the asset level ROR is not shown since it will not make sense. It does affect the other levels of rate of return.

Account Fees In Calculations

These are the management fees which are entered at the account level. Checking this box will make the rate of return slightly lower.

Including management fees will lower the rate of return. If you include management fees, you must always include the Account Daily Cash Balance because management fees are transactions in the account daily cash balance.

This check box does not affect the account values or account transactions listed. It only affects the calculation of the return.

Expenses In Calculations

Expenses include expense transactions which are paid from an investment. Checking this box will have the effect of lowering the rate of return slightly if there are any expenses.

Expenses are different from management fees. Expenses can be applied as a transaction type against any investment. Management Fees can only be applied from the account daily cash balance.

This check box does not affect the account values or account transactions listed. It only affects the calculation of the return.

Account Section

This section applies to criteria which are associated with the account.

Type

This field is useful to provide a report on a single account type for a client. If you wanted to report on a client's IRA, you could choose the client's name and then click on this field to drop down the list of account types.

Objective

This field is useful to provide a report on a single account objective for a client. If you wanted to report on just accounts designed for growth, you could choose the client's name and then click on this field to drop down the list of account objectives. It is understood that often accounts will have multiple objectives. In this case, just leave the field blank.

Account (Number)

Clicking on this field will show a list of the accounts for the name selected. It is best to select the Investor's name in the Investor Section before using this list; otherwise, you may get a list of all of the accounts.

Investment (Asset)

This list should also be used in conjunction with the Investor's name. If you first fill in the Investor's Name, then the asset list will be limited to only that Investor's assets. Otherwise you will receive a list of all assets in your database and it may take a while to populate the list, depending on the speed of your connection to the data.

Other Relations Section

This section refers to other relationships established in Advisors Assistant between the Asset or Account with names in the database other than the Investor.

Producer

This is the Primary Producer listed on the Name record.

Household

This field refers to the Head of Household. Clicking on this field brings up a list of households you have set up.

Primary Owner

When there is only one owner set up in an account (using the Modify Account, Relations Tab), this will be the primary owner. If there is more than one owner, then the second owner will be considered the Joint Owner. This field refers only to a primary owner.

Grouped With

Grouped With is based on the Group With Field contained under the Relations Tab on the Modify Account Information Screen.

The fundamental difference between Grouped With and Households is that Grouped With is selected on the Account Level so you can select just one account without including all of the accounts for that client. This is useful when you want to group certain retirement accounts with the plan sponsor without including all of the investor's accounts.

Click on the field to drop down the list of names to choose which name you want to group with.

Note: This field must be coordinated with the Group With Relations set up in the Modify Account Information Screen. If you have not been grouping accounts with the name you select here, no investments will be selected.

Liquidated Investments

Liquidated investments are automatically excluded if they have a liquidation date prior to the beginning of the measurement period.

If the investment is liquidated during the measurement period, it will be included in the calculation.

Indexes For Comparison Section

This section allows you to include indexes on most of the Rate of Return reports. If a report does not show rate of return, then it will not include the indexes, even if you select the option.

In order to populate the index values for up to the 10 years on the index return section, you will definitely want to subscribe to the Sungard Pricing Service.

Check the box and choose the indexes you want to include based on the indexes you have selected to track. ONLY the indexes you have selected to track through Index Selection will be shown on your drop-down list. If you have not selected indexes, go to the Index Selection Screen.

Click on Search to begin the filter process and proceed to a list of reports.

Why You Cannot Exclude A Single Investment

Other than the Cash Balance Account, which can be listed without return being calculated, we are often asked why other investments cannot be excluded from the calculation. Here are the reasons:

| • | Providing the ability to exclude a poor performing investment could present a compliance issue. |

| • | Calculating the returns on the rest of the assets in a brokerage account when funds are flowing from the excluded asset into the cash balance account and then out to an included investment make the calculation of an accurate time weighted return impossible at the account level because it is not known which flows came from the investment not to be included in the aggregated calculation. It's like double entry accounting. If you exclude some of the accounts, you can't make the rest of the assets balance. |

We allow the cash balance account to be excluded because it will usually have very small balances and it may have hundreds of transactions during a calculation period. However, the balance is still listed on the report.

See Also

Analyzing Investment Data For Logic Errors

|

Return calculations are based on the transactions and cash flows. If these flows are in error, the return will have an error.

Be sure to inspect returns before presenting them to your client. You can use the Performance Calculation Detail Report to see the Average Daily Balance, shown as Avg Bal on the report to see the weighting of each asset's balance into the account and investor return. Other reports show the transactions which often will help with understanding the calculations.

Performance reports don't work if investments in any single account are left out of the calculation because flows in and out of that investment affect other investments in the account. Therefore we do not allow individual investments to be excluded. |