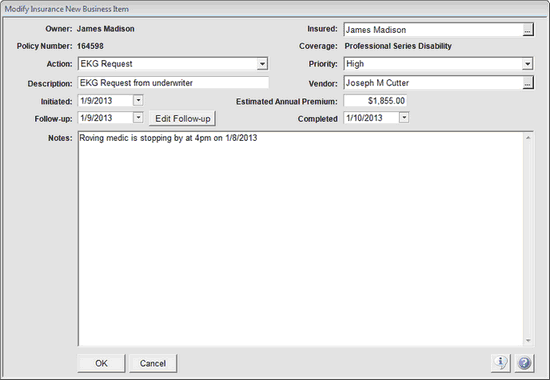

Add/Modify Insurance New Business Item

From the View Coverage With New Business Screen, click on the Add or Modify Action Button.

Add/Modify Insurance New Business Overview

This screen is used to add or modify a new business action to keep track of the underwriting process for policies and coverages.

Insurance New Business Screen

Click on the field field link below for more information on that field.

The Action Field is a drop down list and is designed to save typing. Select the action from the list. When you tab out of the action field, the action will populate the Description Field. You can then edit the Description.

Action Examples

Attending Physician's Statement - Dr.

Blood Pressure Recheck

Description

When you tab out of the action field, the action will populate the Description Field. You can then edit the Description. The Description is the field actually stored in the database and that prints on reports.

Description Examples

Attending Physician's Statement - Dr. Jones

Blood Pressure Recheck

In the first example, the doctor's name was added. Vendor may be left blank since Dr. Jones is not really a vendor.

In the second example, nothing was added and the Description was left unchanged.

Clicking on this field will bring up the Name Lookup list. The Insured's name must first be entered into Advisors Assistant before it can be used..

Estimated Annual Premium

When you are adding a new action, this field will default to the total annual premium for the coverage. For existing items, fill in the total annual premium or the annualized premium. It's your choice.

Edit Follow-up

Click on the Edit Follow-up Button to go to the calendar item. Use this button to assign the follow-up to another associate.

Note: Clicking on the completed field in the calendar follow-up date will ask if you'd like to fill in the New Business Completed Date.

See Also

View Coverage With New Business

|

Use the notes often. It can be important for both errors and omissions and for subsequent underwriting of future policies. |