Trailer Commission Reports

From the Sidebar Menu, Choose the Investments Sidebar Menu. Then Choose Reports | Trailer Commissions

Trailer commissions, sometimes called 12b-1 fees, are payments based on asset balances. This feature is designed to give you an APPROXIMATION of trailer commissions so that you can look for large discrepancies between what you receive and what the Trailer Commissions Report shows.

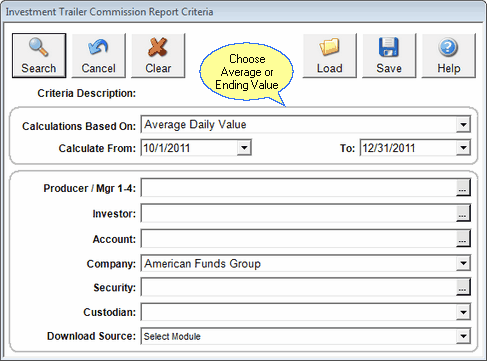

Advisors Assistant give you the choice of using an ending market value or an average market value.

Choose your criteria for the trailer commissions report.

Designed To Approximate Trailer Commissions

Advisors Assistant Trailer Commission Report is not designed to tell you exactly what you should receive in trailer commissions. Trying to match a mutual fund's calculations would be near impossible. However, if the fund pays you significantly differently than appears on the report produced by Advisors Assistant, you should probably look into the situation.

For Example:

Suppose you are being paid 25 basis points (bp) per year, and you enter 6.25 bp 4 times a year. If you run a quarterly report from October 1 to December 31, and you are paid $100 less for a particular account than the report shows, it means that the market value used by the calculation is about $160,000 different.

The difference may be in timing of purchases and may not be a problem, or the difference by be human error at the fund.

Trailer Commissions Begin On The Security Screen

The Add / Modify Security Screen is where you enter the percentage of the trailer paid and the interval. The interval is informational. The Trailer Reports do not divide the percentage entered based on your From and To dates. It does a simple calculation, multiplying the percentage entered on the Security Screen by the market value calculated.

Calculations Based On

You can use the drop down list to choose:

Average Daily Value

This is the average of the market values stored in the system between the beginning and the As Of Date. It is not a simple average between the beginning and end dates.

These values come from two sources. Whenever there is a cash flow in the asset (buy, sell, etc.) Advisors Assistant stores the end of day value. A periodic ending value is also stored based on you the Valuation Interval that has been elected in the System Preferences. It is recommended that you use Monthly if you are doing this report. Even if there is no activity, this will give you a minimum of 3 values to average.

If you change the Valuation Interval, you will need to rebuild the Valuation File in the Investment Utilities.

The average calculated is a simple average and is not weighted for the number of days the balance existed.

Ending Value

This option uses the Market Value on the day chosen for the To Date

Calculate From

This field only appears if you are using an average. It represents the beginning of the averaging period.

Calculate To

Enter the date for the end of the calculation.

Producer / Mgr 1-4

This filter item looks at any of the Producers or Managers on the Account.

Investor

The name of the Investor.

Account

The Account Number. You can run the report for just one account by filling in this field.

Company

Usually this would be the mutual fund company.

Security

The name of the security. You can see the results of just one security within a company.

Custodian

Use this field if you wanted to only see results from one brokerage custodian source, such as Pershing.

Download Source

Often the download source and the custodian will be the same when a brokerage is concerned, but in the case of DST Fanmail and DAZL, the custodian can be the fund company and the download source will be DST or DAZL.

Load & Save Buttons

These buttons let you save templates to run later. It can save time by loading a template and just changing one field.

See Also

Entering Trailer Commission Percentages

|

The percentage paid is entered on the Modify Security Screen. |