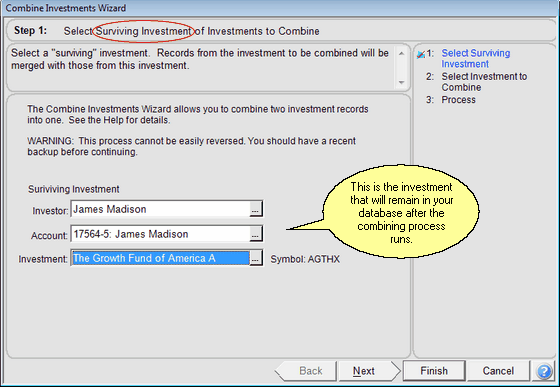

Combine Investment Wizard Step 1

From the Investment Utilities Icon on the Sidebar Menu, click on Investment | Combine Investments.

Combine Investment Wizard Step 1 Overview

You may need to combine investments for a number of reasons:

| 1. | The most common is when a CUSIP changes in a download and the investment is added as a new investment rather than matching it up with one that already exists. This has the effect of having all new data go to the new investment. As long as fund companies report their changes to DST and they are given to Advisors Assistant, this should not happen, but it can and does happen due to slow change reporting by the fund companies. |

| 2. | Two funds combine and the fund companies don't provide sells from the old fund and buys to the new fund. They just start sending the new fund and stop sending the old fund. |

When To Use This Utility

It's important to know when to use this utility and when not to. Use it when:

| 1. | Both investments are the same security. For example, both are IBM Common or both are ABC Growth Fund. Combining investments when they are different securities gets very complicated and should not be done. In the case of a merger when x number of shares in Company A are issued for Y number of shares in Company B, with Company A surviving the merger, a Share Adjustment for Company A may be the best way to go. |

| 2. | There is NO Overlap in transaction history. One investment picks up where the other leaves off. When two transactions are combined for the same day and the same amount, the combining transaction is discarded. |

| 3. | The prices for the investment being combined will be merged into the price history of the surviving investment. Be sure this won't cause problems. |

| 4. | If both investments have Initializing Transactions, the investment being combined will have those transactions discarded. |

What To Do Before Combining Investments

| 1. | Be sure you are backed up recently. You can only reverse this process by deleting and re-adding many transactions or by restoring the entire database. |

| 2. | Be sure you carefully select the surviving investment. |

| 3. | Inspect the transaction history of both investments. Will these make sense when combined? Is there any overlap that does not make sense? |

| 4. | Inspect the price history of both investments. Will they make sense if combined? |

What To Do After Combining

After combining, run the process to Calculate Investment Values for only that client and select all of the check boxes. Check the results carefully.

Field Completion - Surviving Investment

Surviving Investment

This is the investment which will remain in the database after the process is run. It will contain the transactions of the combined investment. The Security Level Information of the surviving investment will not be changed.

Investor

The person or organization listed as the investor in the account. Click on the Investor field to choose the investor for the list.

Account

When you click on the account field, only the accounts held by the investor chosen will be displayed.

Investment

When you click on Investment, only the investments present in the account will be displayed for selection.

Splits

If the two investments are different securities, any stock split transactions for the investment being combined are discarded.

If the two investments are the same security, split transactions are moved as long as they are not on the same day. If the splits are on the same day, then the split for the combined investment is discarded.

Reconciles

Reconciles for the combined investment are moved unless they are on the same day as a reconcile in the surviving investment. If there is a collision, the combined investment reconcile is kept and the other is discarded.

Transactions

Transactions are moved to the surviving investment unless they are considered duplicate transactions. (Same day and amount). In the case of a duplicate, the transaction for the surviving investment is kept and the other is discarded. These are overlapping transactions.

See Also

|

Combined investments should be for the same security. |