Add/Modify Investment-General

From the View Account With Investments Screen, click the Add or Modify Action Button OR from any View Investment Screen, click on the upper left or right quadrant of the screen to modify the investment being viewed or click on the "+" in the upper left quadrant to add a new investment.

![]() Add/Modify Investments (7:30)

Add/Modify Investments (7:30)

Add/Modify Investment-General Overview

If you are downloading from clearing firms, you will normally only be accessing this screen to add data to the screen which is not downloaded. You can also use these screens to add new investments or modify existing information that changes.

Investment Screen Tabs

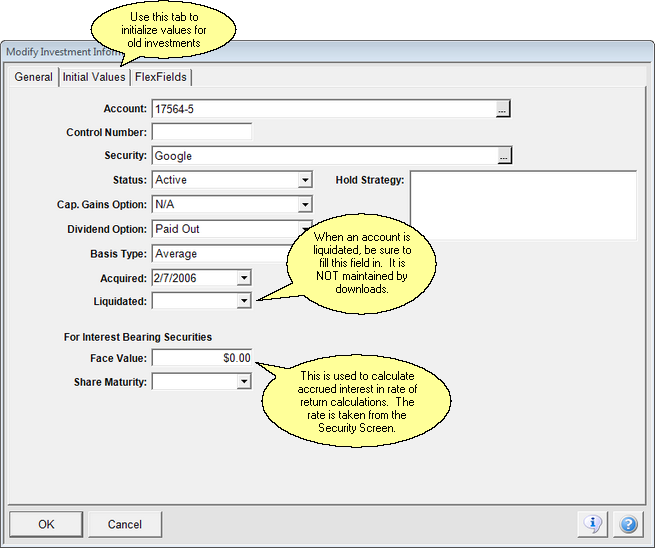

There are three tabs across the top of the Investment Screen. The first two will be used the most:

•General: Information used to set up the investment on reports.

•Initial Values: If an investment is not tracked from the inception of the investment, there will be historical values that must be entered so that new transactions can add to these values. This screen will automatically create these initial value transactions.

•FlexFields: These are fields whose labels you can define based on the type of investment.

Account Number

This is the number assigned to the account by the issuer of the investment. Click on the Browse Button

(![]() ) to get a list of the accounts set up for this investor.

) to get a list of the accounts set up for this investor.

The account must be set up first to be able to add an investment to the account. Additional Help is available for Adding Accounts.

Control Number

This field is filled in by the download at the investment level. It is displayed so that you can see the account number used by the clearing house download. It can be modified on the Modify Account Information Screen.

In rare cases, where a different account number is assigned to each investment and users want to consolidate the investments into one account for display purposes, Tech Support can show you how to create a dummy account without causing the download to fail.

Security

Click on the field or Browse Button to get a list of securities set up in Advisors Assistant. The security must be set up in the Add / Modify Security Information Screen before it will appear on the list. Downloads will automatically initialize security information and put it on the list.

Status

You can use this field to show the status of investments on certain reports. It's useful if you want to keep terminated investments on reports.

Examples

Active

Terminated

Inactive

Cap. Gains Option

Use this to record the option selected for capital gains distributions of mutual funds. Choose N/A or leave blank for a stock. This is for potential reports only and is not used in the logic of the downloads.

Examples

Paid Out

N/A - Not Applicable

Reinvested

Dividend Option

Use this to record the option selected for dividend distributions of securities. Choose N/A or leave blank for a stock. This is for potential reports only and is not used in the logic of the downloads.

Examples

Paid Out

N/A - Not Applicable

Reinvested

Basis Type

This field controls how Advisors Assistant will track basis when a sell takes place.

Examples

Average

LIFO - Last In First Out

FIFO - First In First Out

Not Applicable - Basis is not kept and therefore Unrealized Gain is not calculated. (Not recommended)

Custom - You assign lots to each sale transaction manually.

Acquired Date

This is the date the investment was first acquired.

Liquidated Date

This is the date the investment was liquidated. By filling in this date you can block liquidated investments from showing on view screens and printing on reports.

For Interest Bearing Securities

Face Value

If the investment is interest bearing, enter the Face Value of the investment.

Share Maturity

Enter the share maturity date, if applicable, for the investment. This is designed for situations, such as annuities, when there is a maturity date that is independent of the Security Maturity Date entered on the Add/Modify Security Screen.

Hold Strategy

This is a free form field so that you can describe the Hold Strategy. This may be different from the Hold Strategy at the account level.

Investments belong to accounts. You can move an individual investment to a different account for the same investor, but you can't move it directly to an account for a different investor. You first have to isolate the investment in a "dummy" account and then move that account to the investor by reassigning the account. Once the dummy account is attached to the new investor, you can then move the investment to an account within that investor's accounts by just changing the account number on the Modify Investment Screen (shown above). Then delete the dummy account.

See Also

Add/Modify Investments-Initial Values

|

If you're downloading your investments, you probably won't need to visit this screen unless you need to add additional information not provided by the download service. |