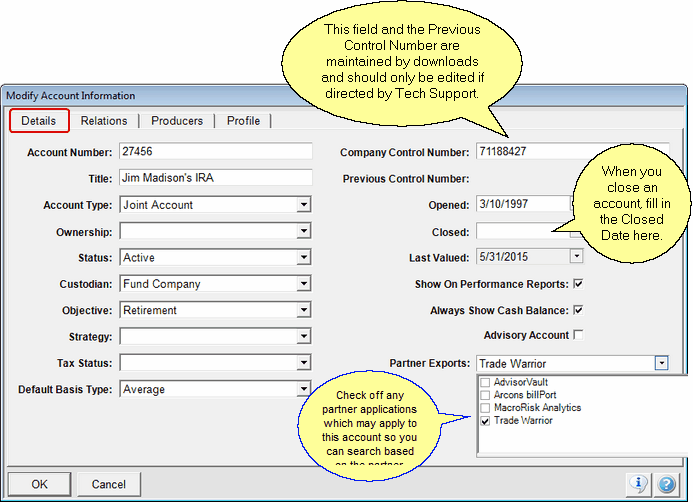

Add/Modify Account-Details

From the View Client With Investment Accounts Screen, click on the Add Action Button OR from the View Account With Investments, click on the "+" button next to the Account Number. To Modify an Account, highlight the account on the View Client With Investment Accounts Screen, and click on the Modify Action Button.

![]() Add/Modify Accounts (5:15)

Add/Modify Accounts (5:15)

Add/Modify Account Overview

Information that applies to all investments in an account is stored at the account level so that you only have to enter it one time for the account.

Additional fields are available for Annuity Accounts

Account Information Tabs

There are 3 tabs at the top of the Account Information Screen.

•Details contains information about the account.

•Relations are the people involved with the account, such as the Investor, Owners, or Group With. Beneficiary information is also kept under this tab.

•Producers are the advisors or reps, and the managers.

Account Number

The number assigned to the account by the mutual fund family, or the custodian holding the security.

Account Title

The Account Title is a freeform field that can appear on reports instead of the Account Type.

The type of account can be edited by users with the security right to edit drop down lists. You will notice that several types cannot be edited or deleted. This is so that the download programs from clearing houses can more easily send data to Advisors Assistant. The list of types are used by clearing houses.

When the Account Type is an annuity, additional fields will appear on the screen.

Examples

Section 529 Education Plan

Community Property

Joint Account

Variable Annuity

Normally this field will be Active or Terminated as chosen from the drop down list. The status does NOT control any processing. It is for information only. If you close an account be sure to fill in the closed date.

Examples

Active

Inactive

Terminated

This is the location where the security is held. It will usually be either the fund company, meaning that the mutual fund company, such as Oppenheimer, holds the shares; or a clearing house, such as Pershing.

Examples

Fund Company

Pershing

First Clearing

Custodian Contact Information may also appear on reports. You can provide this information on the Add/Modify Account Custodian Screen. The information will appear in the Disclosure Section at the end of a report. It is controlled by System Preferences.

This would usually be the same objective entered on the New Account Form. You can add to the drop down list by clicking on Edit List at the bottom of the list, but only if you have the right to edit the list as assigned by the System Administrator. Certain items on the list cannot be edited or deleted because they are used by clearing houses in the downloads.

Examples

Growth

Income

Income and Growth

The Strategy is a set of rules designed to guide the selection of assets for the account.

Examples

Buy and Hold

Indexing

Liability Driven

Click on the field to drop down the list and select a tax status. This is a limited list which can only be maintained by Client Marketing Systems, Inc. If you require that a change is made to this list, contact our Technical Support Department.

Examples

Non-taxable

Taxable

Deferred

This field is used to default new investments at the individual investment level. If the field is left blank, it will default to Average. When a download sets up a new investment, it will check this field and default the basis in the investment to this value.

Examples

LIFO - Last In First Out

FIFO - First In First Out

Average

Interest Rate (Annuity Only)

Enter the annuity interest rate as a percentage.

Mortality & Expense Rate (Annuity Only)

Enter the mortality and expense rate as a percentage.

Company Control Number

This field is maintained by the download programs and should only be entered by users when asked to do so by Tech Support. Often the account number sent by a download and the account number on written information received by advisors is slightly different. If this number is present, it is used by downloads to locate the account. It also allows users to modify the Account Number Field without affecting downloads from clearing firms.

Previous Control Number

If you change a Company Control Number, which means that the account number used by the download has changed, the previous number is still stored by Advisors Assistant and will be used if the present number is not found during the download. This is so that users downloading a week or month at a time will not have problems if the account number change occurs mid week or mid month.

Opened / Inception

This field is used on several reports. It is the date the account was first opened. It is not used for Rate of Return calculations.

For Annuity accounts, the label will be Inception.

The date the account was closed. This is not filled automatically

The closed date will control whether an account is included on reports or included in Rate of Return calculations. The status field does not control any processing.

When an account is liquidated, fill in the closed date. An account can not be liquidated if there are any active investments in the account.

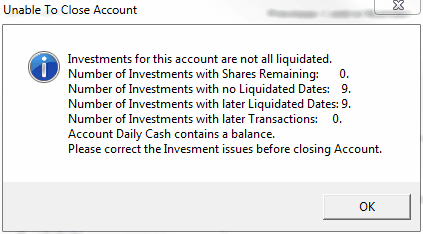

Validation For Closing Accounts

When you fill in a closed date, Advisors Assistant will do validation checks to maintain system integrety.

Unable To Close Account

Shares Remaining

This situation makes it impossible to close an account. The user should go to the View Account With Investments Screen to see which asset still has shares and provide a transaction to bring the shares to zero.

Often downloaded investments will not provide positions for 0 balances. If the selling transaction was missed, the asset can be orphaned. The Investment utility,Resolve Obsolete Investments can help correct this situation. There is also an Investment Liquidation Utility that can be used to help with this task.

Unliquidated Investments

All of the assets in the account must have a liquidation date before the account can be liquidated. There is also an Investment Liquidation Utility that can be used to help with this task.

Liquidated Date Later Then Account Liquidated Date

If an asset in the account has a liquidated date later than the date you want to use to liquidate the account, this does not make sense. Go to the View Account With Investments Screen to locate the investment with the wrong liquidation date.

Transactions After Account Liquidated Date

Advisors Assistant does not allow a liquidation date that is prior to the last transaction in the account. Use the View Account With Transactions Screen and sort the transactions so the latest settle date is at the top and you will locate the offending transactions.

Cash Balance Account With A Balance

Review the cash balance account to see why it still has a balance. Use a transaction to close it out.

Why System Cannot Automatically Correct

The computer has no way to compute just why any of these situations exist. Advisors Assistant is not willing to make the wrong decision on this. An alternative is to delete the account if the data is so bad that it can't be fixed, or create transactions forcing the balance to zero so it can be closed. Be sure to fill in the comment so you will know why the transaction was created.

Last Valued

This is the date the system last valued the account. It is for information purposed only and cannot be edited.

Uncheck this box to remove the entire account from performance reports. You cannot remove individual investments within an account because of the way cash flows between the Cash Balance Account and the individual investments.

Removing an account from the performance reports affects a portfolio's return because the account will not be considered in any return calculation on the report. It is totally invisible to the report.

Always Show Cash Balance

When the cash balance account in brokerage accounts has a zero balance, it is not normally shown on reports. Accounts downloaded from DST do not have cash balance accounts so they are not shown on reports, but they do exist in Advisors Assistant for consistancy..

Checking this box will override the normal logic and the cash balance account, even for DST accounts will show. Do not check this box for DST maintained accounts.

This checkbox is designed to allow you to indicate that this account is part of the RIA practice. There are filters in other parts of Advisors Assistant that let you break out Advisory Accounts. This include View Client With Accounts and the Advanced Query.

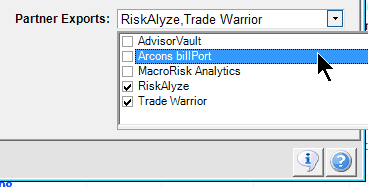

Use these check boxes to designate that this account may be chosen using the Selection Reports. You can also calculate market values only for Partner Export Accounts.

For example:

When you are entering information on an account and that account is one that you want to use selection reports to select that account when you tell selection reports to look from RiskAlyze accounts, you would check RiskAlyze on the list.

Modify Accounts Screen Partner Exports Section

Another example of a Partner Export is TradeWarrior, a software product that rebalances accounts. You can use this checkbox to designate accounts for export for re-balancing.

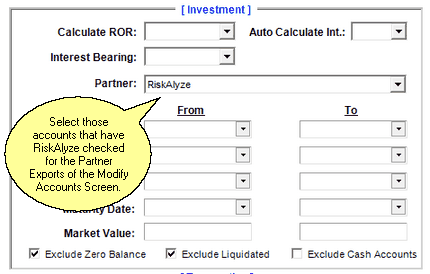

Selection Reports Screen, Investments Tab

The screen above demonstrates how you would use Selection Reports to choose any account that has RiskAlyze checked off on the Modify Accounts Screen Partner Exports.

Annuitization

This is the maturity date of the annuity. When it must annuitize.

Income

The date any income stream is scheduled to start.

See Also

Liquidated Date On Investments