Cash Flow vs Cost Basis

Overview Of Cash Flow

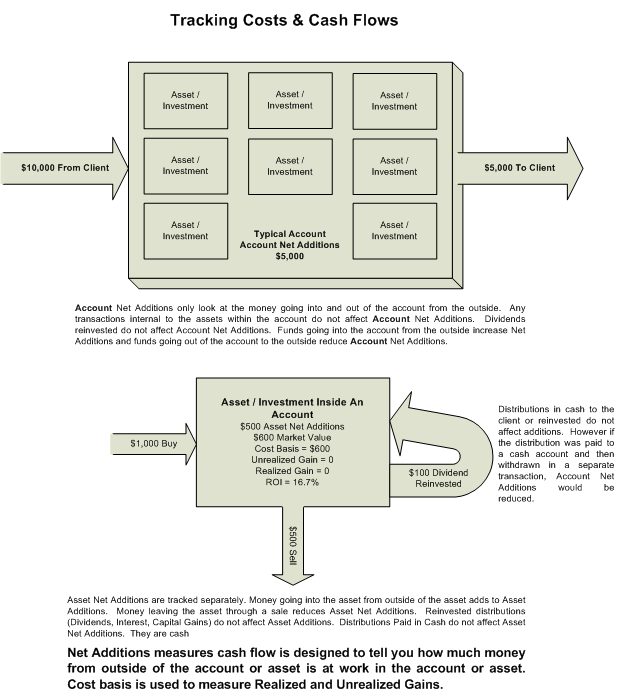

Advisors often want to know how much of their client's money is invested in an account or an asset. Advisors Assistant calculates the cash flow in and out of an account using the value of Account Additions.

Account Net Additions

The account net additions represents the amount of money a client has invested in the account. Any other funds in the account will be the result of distributions.

Examples

Client deposits $10,000 into the cash account. $5,000 is invested in Asset A. Asset A produces a $100 dividend which is paid to the cash account. The Account Net Additions = $10,000

$100 is then withdrawn from the cash account in a separate transaction (from the dividend). The Account Net Additions = $9,900.

Asset Net Additions

Asset net additions represents the amount of money invested in an asset within an account. The funds may have come from the sale of another asset in the account or from funds deposited into the Cash Balance.

Examples:

Asset A is purchased for $5,000 (as in the example above). A cash dividend is paid to the cash account. The asset net additions = $5,000.

$2,500 worth of Asset A is sold and the funds are deposited to the account's cash account. Asset A now has net additions of $2,500.

Additions And Rate of Return

Additions indirectly affects the rate of return because it represents the funds invested. When the ROR of multiple assets is calculated for the account and portfilio rates of return, additions are used to calculate the Average Daily Balance which is used for weighting each asset's return into the portfolio rate.

Why Is Carry Over Basis No Longer Calculated?

Carry over basis was used in Advisors Assistant Version 2 to track the cash flow within the account as funds moved in and out of investments within the account.

This was designed to calculated a value called Net Invested. This value has been replaced by Account Net Additions or Asset Net Additions.

New Calculation Method

Cost basis is now tracked using Lots. When shares are added to an asset, a lot is established with the cost of those shares. These lots are then redeemed as shares are sold. The order of redemption is based on the cost basis method chosen in the Add / Modify Investment Screen.

Cost basis can be calculated based on LIFO (Last In First Out), FIFO (First In First Out), Average, or Custom tax lots.

Calculating any kind of carry over basis using LIFO, and FIFO as money moves from asset to asset within an account and the account is rebalanced several times a year would be impossible.

See Also