Add/Modify Investment Activity

From the View Investment With Transactions Screen, click on the Add Action Button or highlight a transaction and click on the Modify Action Button. OR, from the View Account With Transactions Screen, highlight a transaction and click on the Modify Action Button.

![]() Add/Modify Transactions (6:44)

Add/Modify Transactions (6:44)

Investment Activity Overview

Advisors Assistant stores transactions and uses them to calculate the investment values, such as the number of shares and market value for any particular date. The transaction is the activity.

Each activity is composed of two basic items:

1.The flow of the funds; and,

2.The type of transaction.

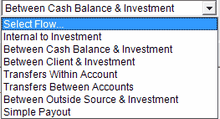

Flow Of Funds

How the funds flow is important in determining if the activity represents new money to the asset or the account. Funds typically flow between clients and investments (mutual funds held at the fund company), between cash balance accounts and investments (brokerage accounts) and internally within accounts or investments (reinvested distributions.)

Type Of Transaction

Once the flow of funds is established, the type of transaction tells Advisors Assistant what happened to the funds. Did they buy shares, sell shares, or get reinvested, etc.?

Only transaction types which correspond to the flow of funds will be displayed.

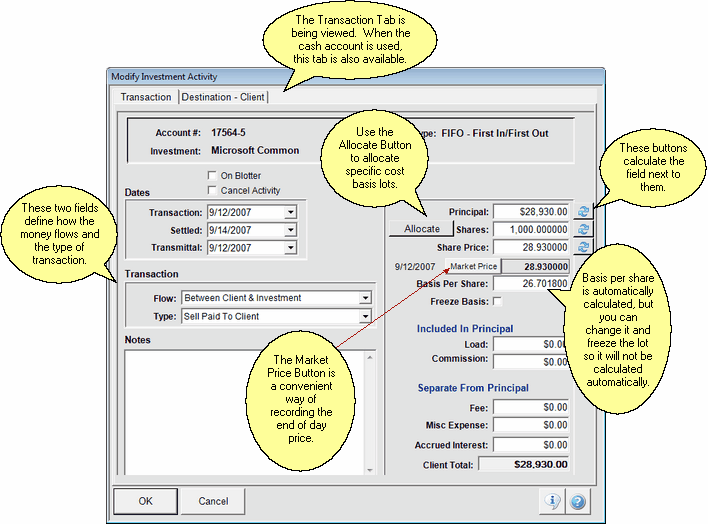

Modify Activity Transaction Tab

Recalculate On Save - Turning Off

When you click on OK, Advisors Assistant will recalculate asset values because you may have changed some item that affects the value of the account.

You can turn off the recalculation temporarily, for your current session, by going to the User Preferences, Investment Tab and unchecking the Auto Calculate box.

Maintaining Transactions

Investment Transactions are typically downloaded, but any transaction can be modified by users provided they have the security rights to make the modification. Even downloaded transactions can be modified.

On Blotter

This field is searchable on selection reports so you can check this field and search for only "On Blotter" transactions to get blotter reports.

Checking this box will also activate the Transaction Blotter Template which is designed to provide you with a list of additional information which is required to be entered into the blotter notes.

Cancel Activity

If this box is checked, it means that the transaction has been canceled. If the transaction involves the Account Daily Cash Balance, that account will be maintained.

For example: If you cancel a Sell transaction and the funds had come from the Account Daily Cash Balance, the funds will be put back into the account automatically.

Transaction Date

Also known as the Trade Date, this is the date the trade takes place.

Settled Date

The date that the funds actually move and the transaction is settled. This will typically be a few days after the Transaction Date. Processing of downloads and reconciliations is based on Settle Date. No unsettled trades are downloaded unless unavoidable.

You can choose whether investment values are based on trade date or settle date in the System Preferences, Investment Tab.

Transmittal Date

If the order is being sent to the broker dealer or the clearing house, this is the date it is sent.

The flow is the money vector. It tells Advisors Assistant where the funds came from or are sent.

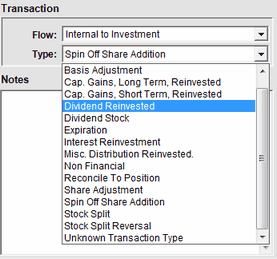

Internal To Investment

Flows internal to the investment are typically reinvested distributions. Even if they are paid to the cash account, if they are coded by the download as reinvested, they are considered a reinvested distribution. The types of transactions for this flow are shown below.

This is type of transaction which is usually entered by the system by running the investment utility of Remove Expired Options or Resolve Obsolete Investments. This transaction type is only available when editing cash balance account transactions. It is used when the investment that created the flow in the cash balance account no longer exists in the database. It will preserve the cash transaction that was the other side of the investment that was deleted.

You can adjust the cost basis as of a particular date by using the Basis Adjustment transaction type. When you use this type of transaction, it has the effect of changing all the tax lots proportionately on a per share basis for buy or transfer transactions (those that affect net additions). If there is an Initialization screen for the asset, that will also be adjusted. Those tax lots are then frozen and will not be automatically changed by the system. The Adjust Basis transaction is also canceled so it will not be used again, but it remains in the system.

Note: If you only need to adjust the basis in on one transaction, just go to that transaction and change the basis per share and freeze the basis for that single transaction.

Spinoffs are usually downloaded from a clearing firm as a transaction that establishes the security which is spun off with the appropriate number of shares. In addition, the "former" parent company will usually have a price decrease.

The number of shares in the former parent will not change, but the price and cost basis will change because value has been transferred to the new company.

Use a Cost Basis Adjustment transaction to adjust down to the new basis on the date of the spinoff. The cost basis for each share of the former parent company is established by their accountants and is not sent in any download or computed by Advisors Assistant.

The cost basis for the spinoff can be established by either the price in the transaction or you can use the basis per share field.

This transaction would always be hand entered. it is designed for the liquidation of a Variable Annuity when the payout is greater than the value of the annuity in Advisors Assistant.

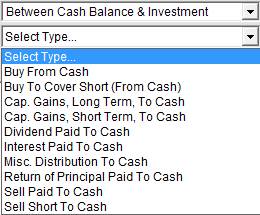

Between Cash Balance & Investment

This is a typical brokerage arrangement. Usually buys and sells involve funds to or from a cash balance account. The types of transactions for this flow are shown below.

Available Types For Flows Between Cash Balance & Investment

In the case of an Account, if an asset's distribution (dividend, interest, or capital gain) is paid to the cash balance account and not reinvested into that same asset, then it is considered Paid Out at the asset level, but since it did not leave the account, it is tracked as staying internal to the account and is considered reinvested at the account and investor levels.

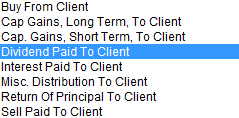

Between Client & Investment

Flows between the client and the investment will typically take place when mutual funds, variable annuities, or cash accounts are involved. The types of transactions for this flow are shown below.

Available Types For Flows Between Client & Investment

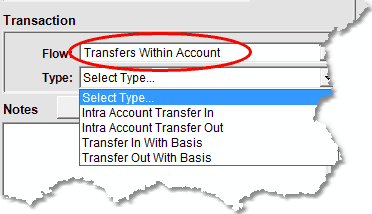

Transfers Within Account

These transaction types are typically appearing when funds consolidate and the consolidation is done through transferring shares.

Transaction Types For Transfers Within The Same Account

Select Investment For Transfer Button

![]()

This button will present you with a list of investments in the same account and will let you select the investment into which or out of which the transfer occurs. This will automatically take care of the other side of the transfer.

With Basis vs Intra Account Transfer

"With Basis" means that the basis of the shares being transferred out will equal the shares of the basis in. You are carrying the basis from the old asset to the new asset. This can be used for exchanging B shares for A Shares.

"Intra Account Transfer" is used by many mutual funds for rebalancing. Shares are actually being sold and then bought, but the funds often refer to the transaction as an "Transfer Exchange".

Note: Transfers within an account may or may not change the basis. If shares with a basis of $5,000 are transferred (with basis) to another asset in the same account, the asset that receives the shares will have it's basis increased by $5,000. The asset with the shares being transferred will have the basis decreased by 5,000. If it is just an Intra Account Transfer, such as used in rebalancing, a new basis will be established by the buy (transfer in) transaction and a realized gain will result from the transfer out.

Transfers Between Accounts

This is a transfer from one account to another. The funds will appear as additions to the account receiving the funds and a withdrawal from the account providing the funds. It is assumed that the two accounts are owned by the same investor.

Transaction Types For Flows That Transfer Between Accounts

Select Account/Investment For Transfer Button

![]()

When you click on this button, the list for all investments for the client, except the current account's investments, will appear. Choose from that list.

Note: Transfers between accounts WILL change the basis. If shares with a basis of $5,000 are transferred to a different account, the asset that receives the shares will have it's basis increased by the value of the shares, just as if it were a purchase or buy transaction. The basis of the asset transferred will be reduced by $5,000. Click HERE for more information about transfers from other portfolios.

Between Outside Source & Investment

A typical example of one of these transactions is a gift of stock.

Transaction Types For Flows To or From An Outside Source

Simple Payout

Simple Payouts are typically used for Management Fees and other account fees. These are only performed at the account level from the View Accounts With Transactions Screen.

Simple Payouts Transaction Type

When a Management Fee is involved, an additional type of transaction is available.

Transaction Types For Management Fees

The type describes the nature of the transaction. These are shown above based on the type of Flow. When you choose the Flow, only those types which apply to that Flow are available.

Notes

Use this field to make notes that may appear on blotter reports.

You can also set up a template to pre-fill the notes. Click HERE for more information.

This is the amount actually used to purchase shares or the amount received from the sale of shares before any expenses are taken.

Use the button next to the field to have the system calculate Principal when the Shares and Price are filled in.

The number of shares involved in the transaction. Advisors Assistant tracks to 6 decimals when necessary, such as for a variable annuity. It uses the number of places sent in the download.

Use the button next to the field to have the system calculate shares when the Principal and Price are filled in.

The price per share for this transaction. This is not the same as the Market Price which is the closing price for the day.

Share price gets calculated if you fill in Principal and Shares. You can also click on the button next to the field.

Allocate Button

The Allocate Button is only visible on transactions where basis lots are allocated. If you want to allocate the shares being disposed of on a custom basis, click on the Allocate Button.

Market Price Button

The Market Price Button is a quick way of entering a closing price for the security. Normally Market Prices are downloaded, but if a Market Price has not been downloaded for the transaction date, you can enter it here.

Price Date

This is the date associated with the closing price shown next to the Market Price Button.

The basis per share is calculated by Advisors Assistant, but you can override it. Normally you would use the Allocate Button if it is a sell transaction and you want to allocate more than one transaction to the sell. If you change the basis per share, you should freeze the lot or it will be recalculated.

How the system treats the basis of reinvested amounts is covered in the Add/Modify Security Screen.

Freeze Basis

This check box allows you to tell Advisors Assistant never to calculate the basis for this transaction. If you use the Allocate Button, this box will be checked when you save the allocation.

Included In Principal - Load

In the case of a mutual fund, if there is a load included in the principal, it can be entered here. This field is not usually supported by downloaded transactions.

Included In Principal - Commission

Commissions paid to the producer or BD can be entered here, but they are not normally available in downloads.

Fee

This fee is for Transaction Fees. It is not for Management Fees. The fee field will add to purchases and subtract from the principal in the case of sales.

Misc Expense

This field provides a second fee field in the event you wish to break out fees or the clearing house assesses two kinds of fees.

Accrued Interest

This is the accrued interest involved in bond transactions. It is taken into account when calculating rate of return.

Client Total

Client Total is calculated as Principal less fees plus or minus Accrued Interest.

See Also

Settle Date vs Trade Date Affect On Values

Bond Transactions - Manual Entry

|

You can use transaction screens to enter transaction history which is not available to download for key clients. |