Insurance Commissions Overview

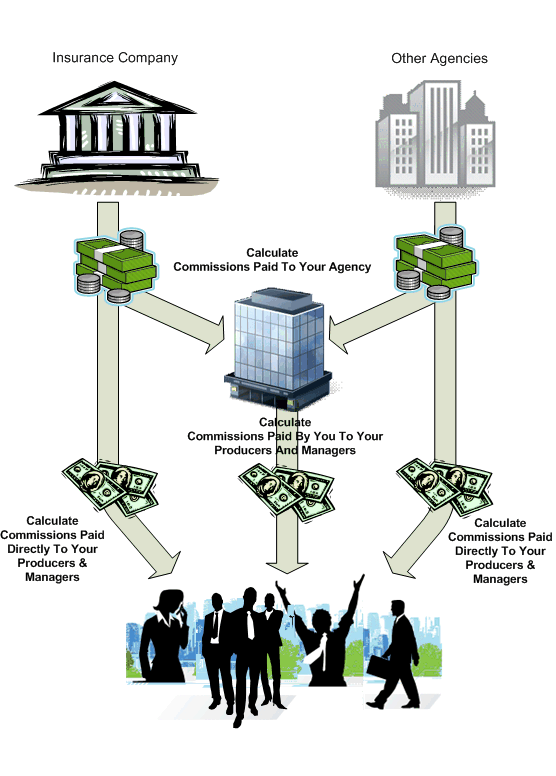

Calculate Commissions Paid To Your Agency, Producers, & Managers

Who Would Use Insurance Commission Tracking

Advisors Assistant's Insurance Commission is designed for two types of users:

•Agencies that pay their producers and managers commissions based on premiums, participants, fixed amounts, or commissions they receive.

•Agents who want to audit their commissions received.

What Commissions Will The Insurance Commission Module Calculate?

Advisors Assistant will calculate any combination of the following commissions:

Agency Commissions

•Agency Commissions based on a percentage of a basic premium and up to 2 different excess premiums.

•Two different level of overrides with different percentages for each level AND each of the 2 excess premiums.

•Fixed amounts of commissions periodically paid per contract sold and scheduled by policy year.

•Commissions paid per participant.

•Trailer commissions paid on the cash values less outstanding loans.

•Amounts of premium that are not commissionable can be excluded from the commission calculations.

•Different coverages within the same policy can have different commission rates and payouts.

•Riders on coverages can have different payouts than the underlying coverage.

•Set blackout dates for when teachers have summers off from school and are not paying premiums.

•Net commissions kept by the agency after all parties are paid.

•Commissions remaining after a partial payment is received by the agency.

Agent (Producer) Commissions

Producer level commissions have all of the same features listed above plus:

•They can be based on a percentage of premium or a percentage of agency commissions.

•They can be split with different splits for first year and renewal years.

•Producer commissions can be tracked even when they are paid directly by the company.

•Up to 4 Producers can be listed on any one policy.

•Unlimited numbers of Producers can be tracked.

•Producer Transmittal Reports pre-addressed to use window envelopes.

Manager Commissions

Manager commission levels have all of the same features of the agency commissions plus:

•They can be based on a percentage of premium or a percentage of agency commissions.

•They can be based on a percentage of a producer's commission.

•Up to 4 Managers can be associated with any one policy.

•Unlimited managers can be tracked.

•Single Transmittal Reports can accommodate producer and manager commissions for the same person.

Advances and Chargebacks

•You can also provide for first year commission advances and chargebacks for commissions that were advanced and not paid to the agency.

Expenses

•Expenses such as phone expenses or rent can be deducted from a producer or manager's commissions.

Commission Security

The Advisors Assistant Insurance Commission lets you not only control access to the module, but it also lets administrators control who can perform specific tasks, such as setting up rates, within the module.

How The System Works

The basic steps for tracking commissions are as follows:

1.Enter the Commission Rate Tables

2.Enter the Insurance Policies

3.Calculate Commissions

4.Post Commissions

5.Print Commission Reports

We recommend that as you’re getting started, don’t try to enter all of your rate tables and policies before you start calculating commissions. If you entered the rate tables incorrectly you’ll have a lot of editing to do.

The best thing to do is select a couple of different rate scenarios from one insurance company. Enter those rate tables, and then make sure that you have some policies in the database using those rate tables. Calculate the commissions, and if those transactions calculate correctly you can continue entering more rate tables and policies.

Once you understand the process and your commissions are calculating correctly, finish entering one company first, so you can begin posting all of that company’s commissions. Then move on to the next company.

Once you have your rate tables and policies entered, on a monthly basis you’ll just

1.Calculate Commissions (Advisors Assistant does all the work!)

2.Post Commissions

3.Print Commission Reports

Advisors Assistant keeps track of what commissions should be paid to the agency and also which commissions have been received by the agency. It then presents this data in various reports for both internal use and reports designed to be sent to the producer with their commission check (in the case of an agency paying commissions.)

Commissions Due

Advisors Assistant scans your policy and coverage records for coverages which are set to calculate commissions. This scan will create a "Commission Due" transaction based on commission rates entered into Advisors Assistant's rate tables.

Error and Warning reports are presented after each scan to alert you to missing data. You can drill down on these reports to go to the location in the system that will allow you to fix the problem.

Commissions Paid

When commissions are received from the company paying your commissions, you can go through the commission list you receive from the company and post the commission into Advisors Assistant as having been received. You can post a commission with just one keystroke (Home Key), so you don't have to enter the amount of commission received when it matches the due amounts.

Paying Your Producers

Once you have posted your commissions, Advisors Assistant will know the amount you have contracted to pay the producers and managers on the policy for that commission cycle. You can then print commission transmittal reports to accompany the checks you send to your producers.

Agency Net Amounts

Advisors Assistant also tracks, on a policy by policy basis, the net amounts which are retained by the agency after all producers and managers have been paid.

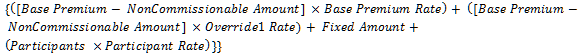

There is a basic formula applied to all commissions. The formula can repeat itself for one commission calculation depending on how many commission components a single insurance product may contain.

![]()

Base Amount

The Base Amount depends on what the rate is being applied to. The base amount may be the modal premium, or it may be the agency commission, or it may be the number of participants, or the policy cash value.

Rate

The Rate comes from the Commission Rate Table. Each of the Base Amounts mentioned above, and more, can have a rate assigned to it.

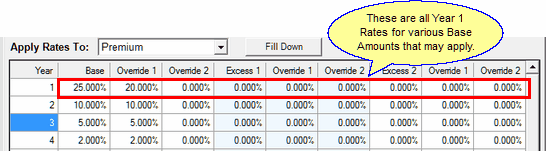

Premium Rates That Can Be Applied In The Formula

In the illustration above, the basic modal premium has a rate of 25% and the basic modal premium has an override rate of 20%.

Case Split

The case split is the split between two producers. It is not a split with the agency. For details on how the math works with case splits, please click HERE.

Typical Formula

If an insurance company paid a basic commission and one override commission based on the basic premium, and they paid a fixed amount once a year on each policy plus a participant fee, but they did not pay any commission on a setup fee, the formula might look like this:

Note that Non-Commissionable Amounts are subtracted from the modal premium.

Commission Reports

Advisors Assistant prints a variety of commission reports:

•Reports showing commissions due vs those paid or posted.

•Reports showing how much producers are owed.

•Reports showing the net commissions retained by the agency.

What To Do First

1. Enter Rate Tables

Your first step is to tell Advisors Assistant how much you, as an Agency, are paid on each Coverage Type by the insurance company or the entity upstream which writes you checks. This involves setting up your Rate Table Sets.

After setting up the Agency Rate Table, if you are paying other producers, add those producers to each of the rate tables. You can have a default producer rate table and/or as many custom producer rate tables as you want.

2. Set Up Your Policies

Each policy needs to be set up to calculate commissions.

3. Calculate Commissions

When calculating commission transactions Advisors Assistant actually does the work for you. You just tell the program what date range to calculate.

See Also